Advantages of Forming a Corporation

Forming a corporation in Delaware can cost between 1-2K more than in other states. Forming a Business Corporation in New York.

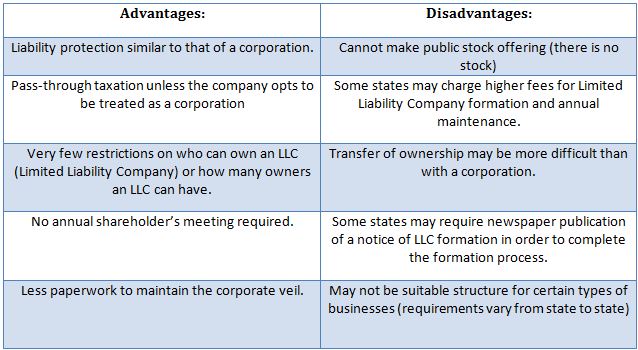

Advantages And Disadvantages Of Limited Liability Company

New York recognizes many business forms including corporations limited liability companies limited partnerships sole proprietorships and general partnerships.

. Every LLC should have some type or types of business insurance. For any particular venture personal and business circumstances will dictate the business. The biggest advantage is that both structures limit the liability of owners meaning the owners are not personally responsible for the businesss liabilities and debts.

An S corporation also called an S corp or an S subchapter is a tax election that lets the IRS know your business should be taxed as a partnership. It also prevents your business from incurring. New York recognizes many business forms including the limited liability company LLC corporation limited partnership sole proprietorship general partnership and other less familiar forms.

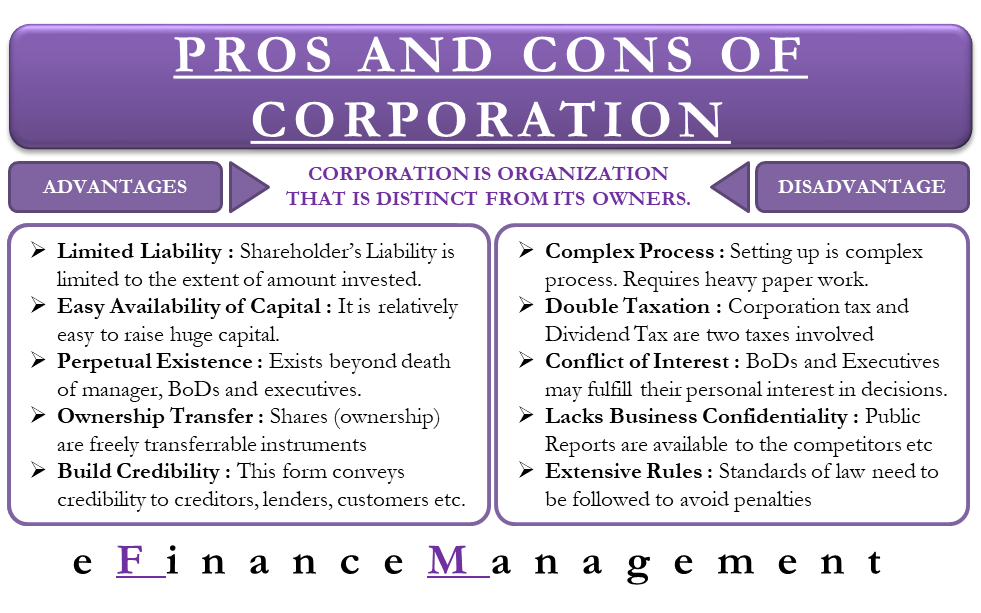

A corporation will generally have more formal record-keeping and reporting requirements than an LLC. You will have to pay registered agent fees to receive legal correspondence if your business isnt in Delaware. Whats the difference between a C corporation and an S corporation.

One of the main reasons that people choose to form an S corporation is to save. Each corporation customizes their own corporate bylaws template and every Delaware corporation has the right to adopt amend and repeal its bylaws per Delaware General Corporation Law 1225. For any particular venture personal and business circumstances will dictate the business form of choice.

At a minimum your LLC should probably have general liability insurance which is a broad insurance policy that protects your business from lawsuitsOther insurance policies an LLC may need depend on the type of business if you have employees or not and other factors. A public limited company PLC is the legal designation of a limited liability company which has offered shares to the general public and has limited liability. Recurring annual cost for registered agent and attorney in Delaware.

Public Limited Company - PLC. Heres what you need to know to get your LLC up and May 02 2022 4 min read. But there are valid reasons to choose a different structure for your new business.

Decide on a Name. Each has its advantages and limitations for specific situations and therefore you should seek the advice of competent advisors to select the entity type that best fits your needs and business objectives. When incorporating your business you may choose to form either a C or S corporation.

Corporate bylaws are typically adopted in the initial meeting of the Board of Directors held after the business has been incorporated. Each has its own advantages and disadvantages. Forming a corporation or LLC has some definite advantages.

Voestalpine Roll Forming Corporation supplies custom roll formed metal components into several industries including Aerospace Construction Material Handling Off-Highway Office Furniture Solar and Transportation. Forming an LLC is easy but some states take longer than others to process new LLC filings. Voestalpine Roll Forming Corporation.

Decision-Making Being the only one to make decisions has its advantages and disadvantages. Each has its own advantages and disadvantages. Unlike in a corporation where there are investors who can make additional investments should the need arises sole proprietorship often results to some owners relying on their personal money and loans to operate the business.

Forming a Delaware corporation is a formal streamlined process and the following sections provide a practical overview. Your choice is important so you. These charges can range from 129 per year.

Why Is A Corporation Better Than A Sole Proprietorship

7 Benefits Of Starting An Llc Llc Benefits Truic

No comments for "Advantages of Forming a Corporation"

Post a Comment